Hello everyone!!! It’s been awhile I’m away from blog! Haha..so, here we go. Let’s start with financial planning for year 2023..hahaahaha..yes…for 2023!! Let’s plan for future! LOL

Okay, I’d checked on whatever resource I have, google, youtube…etc. So, I found the rules 50:30:20. It’s kinda interesting to check on. So, I made some calculation and hey yaa!!! I managed to get more savings! Yay!!! Way to go…minimalist lifestyle 🥳🥳

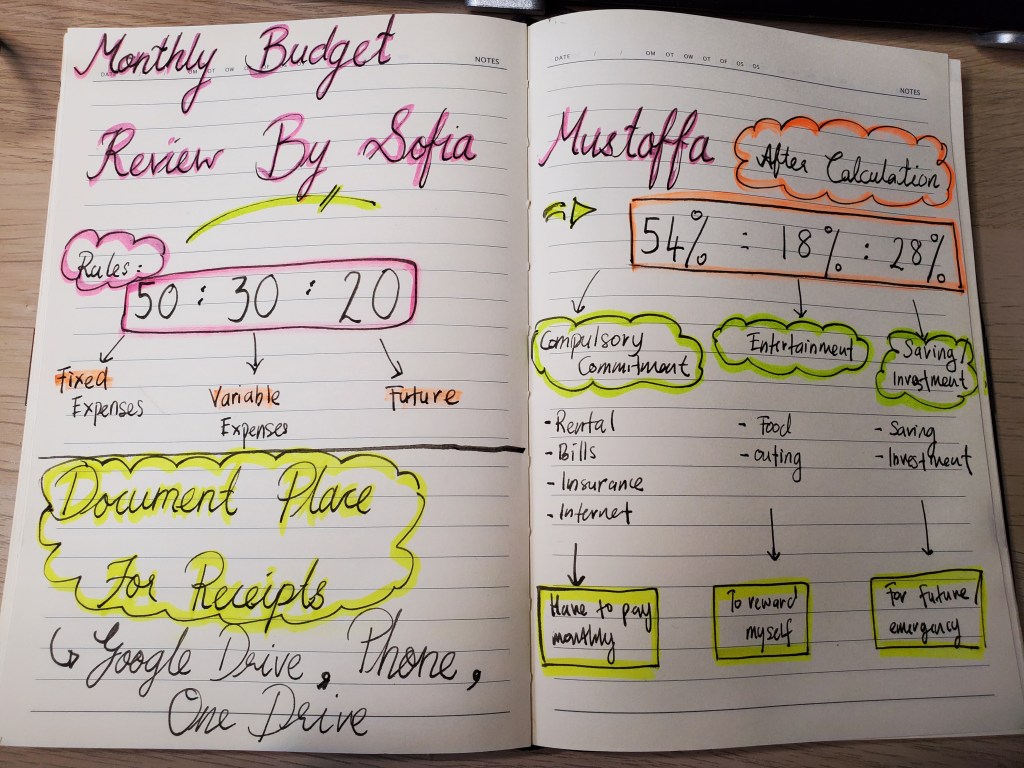

Monthly Budget follow rules 50:30:20 …

For rules 50:30:20, this is the percentage that you need to allocate your monthly income. There are 3 categories, the 50% should be the Fixed Expenses that you will need to pay such as bills, rental, car, internet, tuition fee etc (compulsory to pay). For the 30% of your salary should go to Variable Expenses that you have options not to spend such as eating outside, movie, theme park, present, etc. The remaining 20% should go to your Future Plans such as emergency savings or any possible investment. Well, after the calculation, I had found out that my Fixed Expenses is 54% (slightly higher because I included insurance with investment under this category 😄), my Variable Expenses is 18% (I dont have much things to buy, just lil bit entertainment like movie/eating outside) and for Future plans I have 28% 😃. I think this is good enough. As a minimalist, I always conscious on what to buy so that I don’t waste my money for clutters 😃

Okay, how do I calculate all of these? Haha..im using a simple ratio calculation 😜

Let’s take example, income salary RM2000 and to follow rules 50:30:20 (%).

In this example, when you calculate all your bills (plus other compulsory to pay) and it total up for example RM 900. So, a simple ratio (900/2000) x 100 = 45%. So for those who has salary RM2000, how to calculate is to manage the Fixed Expenses below RM 1000, RM 600 for Variable Expenses and RM 400 for Future plans. 😃

Where to store your monthly receipts for Tax Relief ?

Okay, I usually save in cloud, so easier to trace it. So, Im using Google Drive most of the times. Perhaps, you can have some other storage as well like One Drive. It is not really advisable to store in phone, as Phone can easily spoil then you will need to factory reset and all will be gone.

Okay, next I’m gonna explore how to diversify the savings and investments..till then..to be continue…

Love, Sofia