Hello friends!

Wow, it’s been 10 months since I updated my blog due to workload and stress. Finally, I’m freedom from Corporate World! haha, temporarily 😃

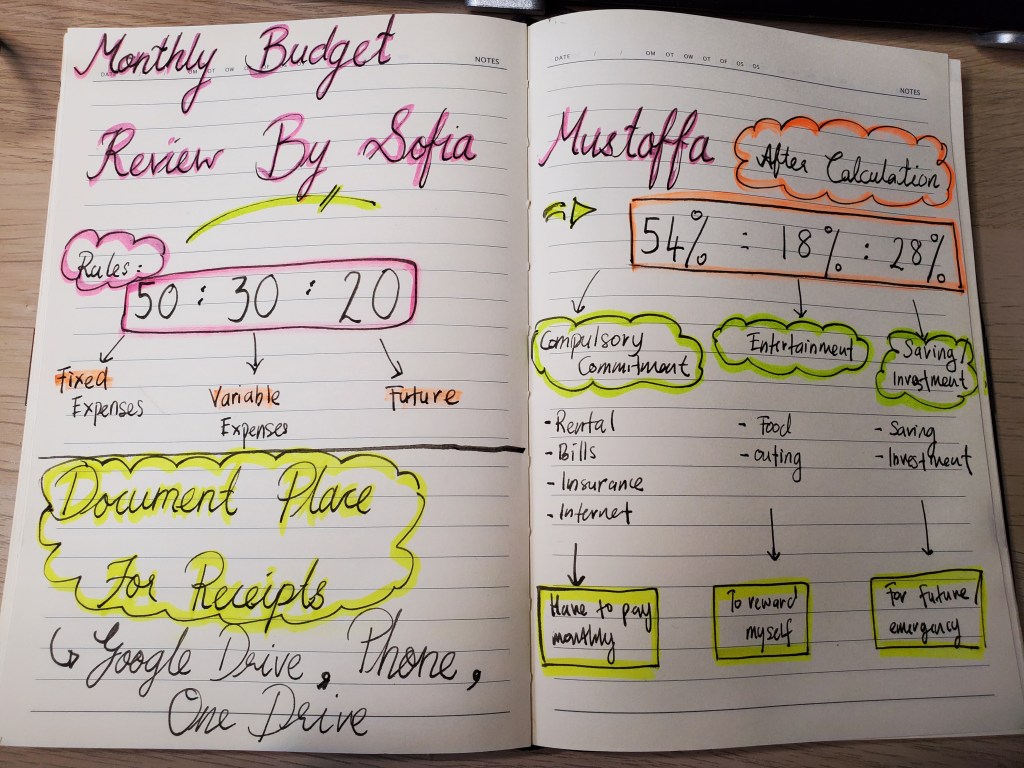

I was thinking, due to economy not stable etc, our daily expensive increase significantly lately. I know I need to do some side income, because daily life these days becoming soo expensive. I’m still survive, because of my minimalist living. But I want more than enough so that I can help those who need it, especially my families.

I’ve seen in front of my eyes how people who used to have millions in their account on surviving mode now. In my country, Malaysia, most people are working in Corporate Company, having EPF (Employees Provident Fund) saved monthly with free contributions from employer, monthly. But, I saw when they reached 55 years old and finished their saving money even before they reached 60. It’s stipulated in my mind that I still need to work even though I reached a mature age of 55 years old to take out my money.

Here is the thing on what usually happened, when someone reached 55 years old, most scammer can “smell” the new money. So, mostly people will fall for scammers. Well, I don’t wanna be such. I wanna build my own business right now, so by 55 years old, it can run itself with minimal supervision.

If you wanna get into business in Malaysia, you need to register SSM (Suruhanjaya Syarikat Malaysia) and choose an appropriate type of business. Well, it was not a smooth process for me, but eventually I managed to get my SSM certificate. Yay!!

So, here we go, bismillah to start my business.

pssstt, well, I had eventually finished renovating my new home. Will share in the next blog on my new renovated home and share some tips on how to manage new house renovation from the beginning. 🥰

till then, to be continued…

Love, Sofia ❤️

p/s: Notes to my corporate world: 😝