Hi everyone and Salam Maulidur Rasul to all Muslims. How are you today? Hope you are well and blessed.

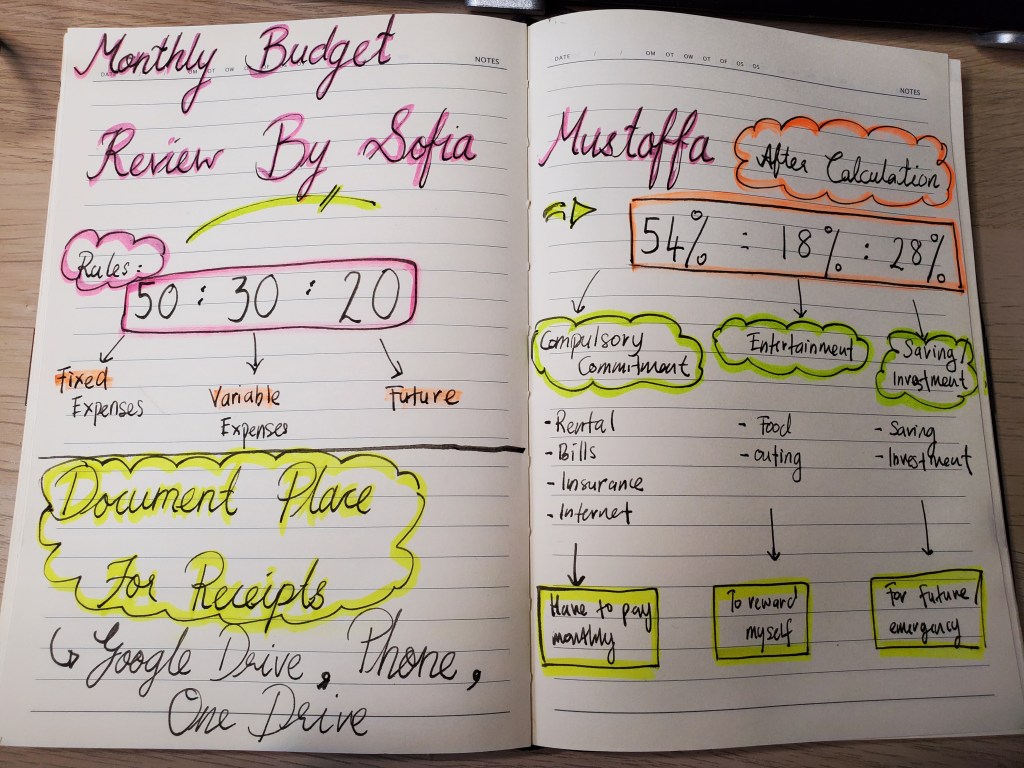

Just want to share one of my addiction now, which is a factor on how do I shift from negative cashflow to positive cashflow.

Previously, I’ve been so demotivated on workload etc of my surroundings. I try to find something that I love to do, which is valuable for future.

So, it happened from my sister and my mom influence on buying golds. The main support comes from my dearest person who always gimme moral supports and motivation to make gold collection.

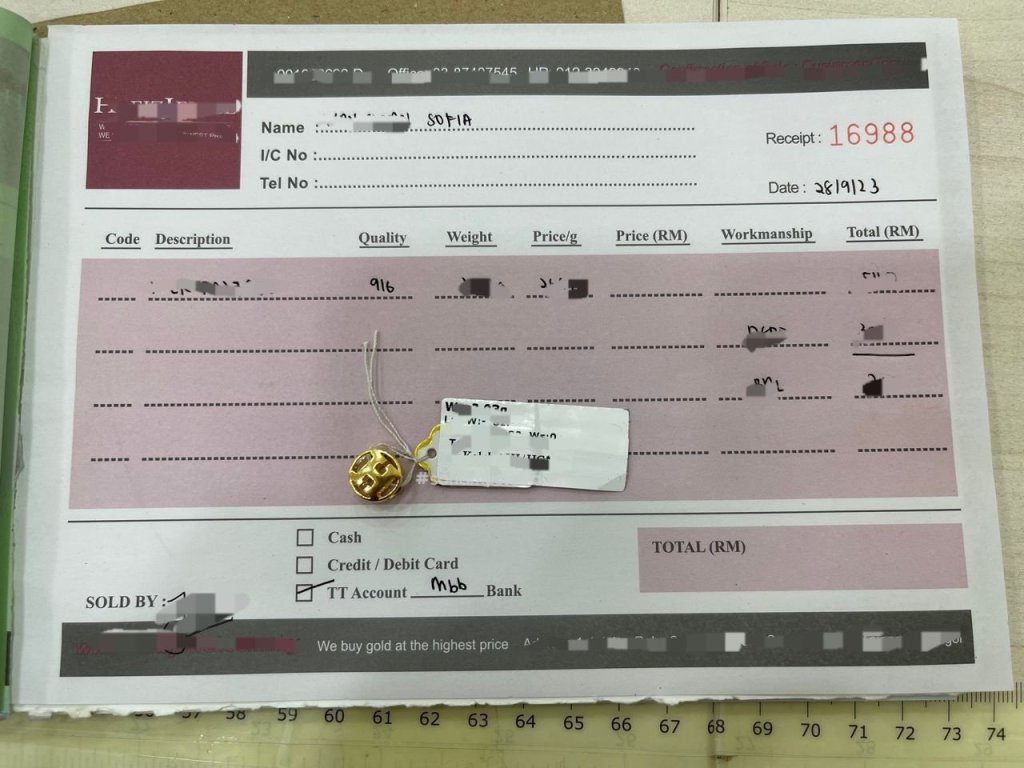

I found adorable Pandora beads online, Starbucks 916 gold which is my fav one. 🥰

I think I’m gonna start coffee and food collection since I love coffee and Im foodie… hahaha!! 😃😂

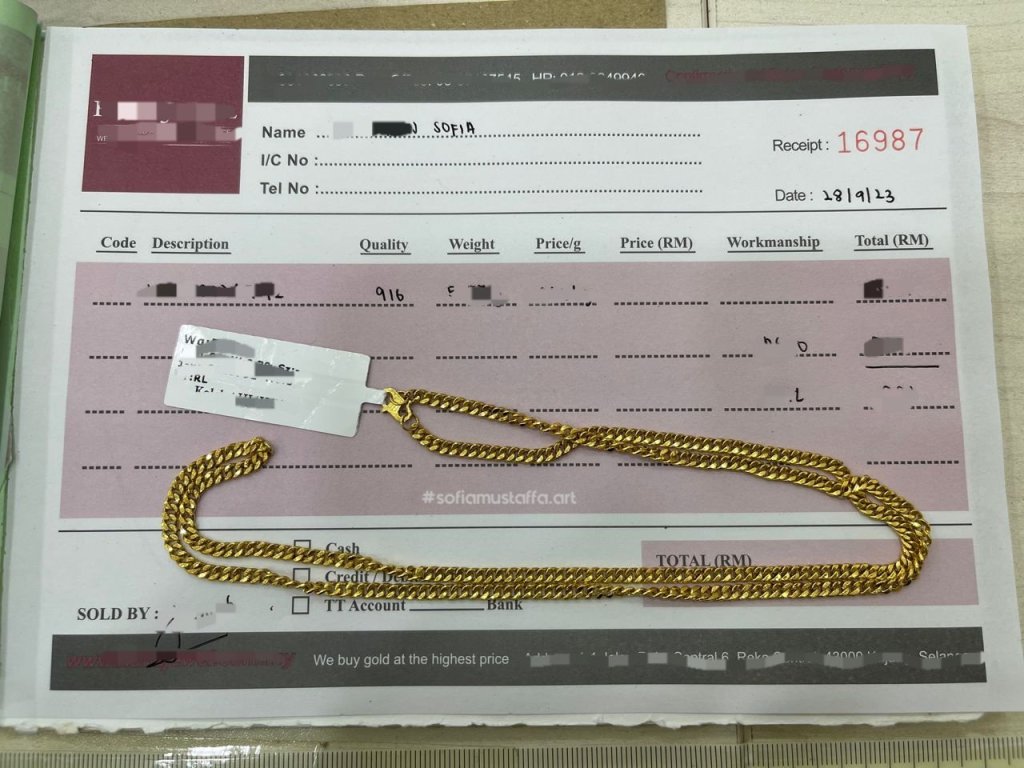

This month, I managed to buy 2 sizes starbuck beads- Venti & Grande. I’ve seen Coffee Grinder Gold Beads before, and I wanna find it for my next month budget. Just to add-on to my Coffee & Food collection. Other than those, I managed to buy necklace with Hermes Beads. Yeaahhh!!! ❤🌹🔥

Can’t wait for my next adventure…looking forward for more cute 916 gold Pandora beads for future..weee!!! 🥰

Heheheehe..thats all for this month…lets see what we will have for next month. I hope I can find the coffee grinder ❤🥰❤

till then, to be continued…

Love, Sofia